Occupy Your Local Money System

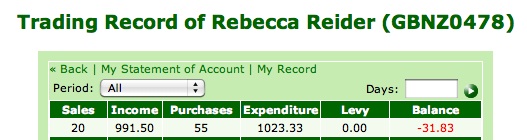

I recently went into debt, officially. My account balance on the computer screen has turned red, with a big minus sign next to it. And I’m happy about it.

Why? Because while Wall Street et al make billions off of loaning us all dollars and charging us all more dollars in interest, I went into debt in our local currency, H.A.N.D.S. (How About a Non Dollar System), in Golden Bay. The HANDS system will not charge me interest just because my account has dipped below zero. In fact, our community trading system thrives on people “moving through zero” – so much so that the HANDS committee even organised a design competition last year to choose a logo (pictured below right) embodying the “move through zero” concept.

Why? Because while Wall Street et al make billions off of loaning us all dollars and charging us all more dollars in interest, I went into debt in our local currency, H.A.N.D.S. (How About a Non Dollar System), in Golden Bay. The HANDS system will not charge me interest just because my account has dipped below zero. In fact, our community trading system thrives on people “moving through zero” – so much so that the HANDS committee even organised a design competition last year to choose a logo (pictured below right) embodying the “move through zero” concept.

The right wing is quick to laugh off the Occupy Wall Street movement as it takes hold of more city plazas every week: Are you protesters just venting your anger, or have you got a better idea? Well, yes, we do have a better idea – lots of better ideas. And community currency is one of them.

The right wing is quick to laugh off the Occupy Wall Street movement as it takes hold of more city plazas every week: Are you protesters just venting your anger, or have you got a better idea? Well, yes, we do have a better idea – lots of better ideas. And community currency is one of them.

When I am in debt to the HANDS network, all it means is that my community trusts me to pay it back. Someone else is in surplus; I trust them to spend it. I might sell plants I’ve grown, teach a writing workshop, buy firewood, hire a housecleaner (all things I’ve done using HANDS). This is the point of our community currency: not accumulation, but an ongoing flow of exchange.

When a new member signs up to the community currency network in Golden Bay, she begins with her account balance at zero; the only way she can earn/spend HANDS is through trading goods and services with other members. So it follows that about half the people in the system at any given moment may be in surplus, while the rest may be in debt. As a whole, we are balanced, a human ecology of give and take. There are hundreds of HANDS members, but in the system’s 22 years of existence, only a HANDful have ever left the network irresponsibly, moving away without paying their debts back to the community. This is what relocalisation of currency is all about.

Okay, so I’m less than 50 HANDS in debt right now – no big deal. But recently a friend overdrew her Bank of America checking account by US$2 and they charged her a $40 fine. Why? I doubt her overdraw cost Bank of America anything. But that’s how the banks have learned to play: take from us at every opportunity. Whether on the microscale (a $40 fine) or the macro (US$760 billion of taxpayer money squandered in the 2008 bailout of Wall Street), they’ve learned they can do it, so they do. And we have let them.

When we take our currency back, we take back our energy. At a recent HANDS market in Golden Bay, on a warm green Sunday afternoon, I watched community members connect and trade in HANDS. I bought goat’s milk from a former neighbour’s goat, a blanket from someone else who was moving away, a bowl of curry from a friend, while catching up with acquaintances and listening to local artists play music in the background.

At afternoon’s end, dozens of people of all ages sat down on the grass and watched as a small group enacted the HANDS system’s hallmark skit, “The Money Myth Exploded.” It’s a humorous sketch about a group of people who end up on a deserted island and find themselves enslaved to a banker who insists he has a hidden chest of gold. The banker slyly lends everyone money, and then forces his fellow island-dwellers to work constantly to pay off their debts, with interest, while he lies back and rakes in the profits. Eventually, however, the community members wise up, and see that their emperor has no clothes. There is no gold in the box. And they realise that the banker is the minority, they are the majority; with strength in numbers, they confront him (in the photo above), force him to cancel their debts, and then grudgingly let him into their own mutual credit barter system if he’s willing to work. And then they have a dance party, and they all live happily ever after.

At afternoon’s end, dozens of people of all ages sat down on the grass and watched as a small group enacted the HANDS system’s hallmark skit, “The Money Myth Exploded.” It’s a humorous sketch about a group of people who end up on a deserted island and find themselves enslaved to a banker who insists he has a hidden chest of gold. The banker slyly lends everyone money, and then forces his fellow island-dwellers to work constantly to pay off their debts, with interest, while he lies back and rakes in the profits. Eventually, however, the community members wise up, and see that their emperor has no clothes. There is no gold in the box. And they realise that the banker is the minority, they are the majority; with strength in numbers, they confront him (in the photo above), force him to cancel their debts, and then grudgingly let him into their own mutual credit barter system if he’s willing to work. And then they have a dance party, and they all live happily ever after.

A fanciful story perhaps. But maybe a prophetic one? Is that what’s happening now, germinating in the Occupy Wall Street movement that is now occupying cities across America and across the world? The people are waking up: the emperor has no clothes. His money system is a collective hallucination that has kept the rest of us chained to the debt-treadmill for far too long.

As long as our paychecks go into those big banks, we are complicit. It’s occupy or be occupied. Yes, we still need to use money in this world – so at the moment I’m joining the thousands of people who are taking our accounts out of megabanks and putting them into local credit unions, which offer standard banking services but are owned and governed by their members. And I’m keeping my debts local. Eventually the banker on the island will realise he’s outnumbered, and that we’re not going to play his game.

Rebecca / Redwood Reider is a writer and performance poet living in Golden Bay. For more of her explorations of new world visions, visit www.myspace.com/rebeccapoetry and dreamingthebiosphere.com.

Rebecca / Redwood Reider is a writer and performance poet living in Golden Bay. For more of her explorations of new world visions, visit www.myspace.com/rebeccapoetry and dreamingthebiosphere.com.

loading...

loading...

Tags: HANDS

2 Comments »

2 Pingbacks »

[…] Source : happyzine.co.nz […]

[…] Source : happyzine.co.nz […]

Local credit unions, time banks and complementary currency systems are sure to be on the rise in coming years, whether as a response to austerity or as a way to rediscover our sense of community.

At some point we’ll reach a tipping point in the number of people who understand our methods of money creation and the addiction to perpetual economic growth which is necessary to support it. Hopefully people will come together to innovate alternative methods.

loading...

loading...

Good to hear from you John.

loading...

loading...